Megatrends and market environment

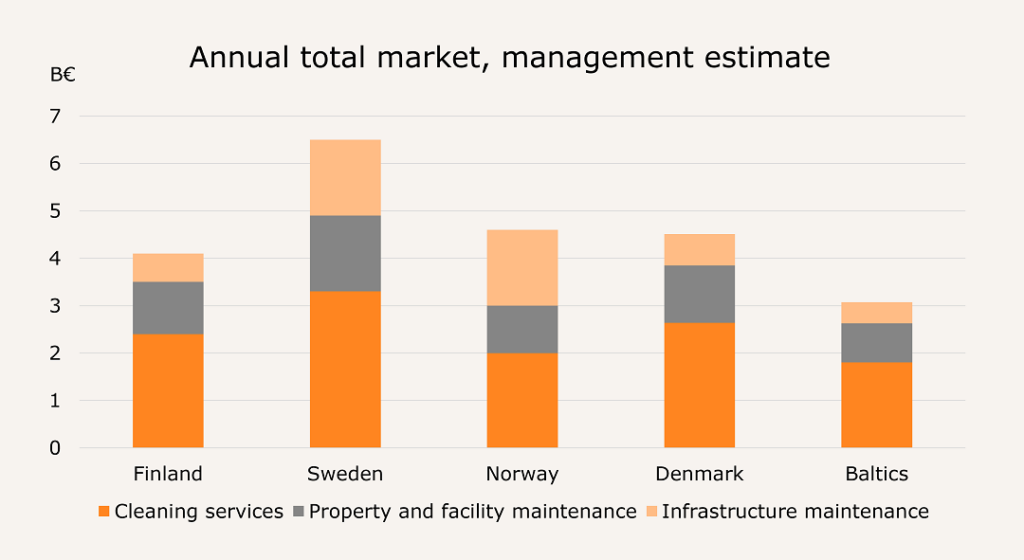

We operate in a steadily growing, approximately 23 billion euro industry in the Nordic and Baltic countries. While industry growth has remained steady, several megatrends are affecting the industry over the coming years. We expect especially energy transition, cyber security, climate change and digitalisation to act as growth drivers creating demand, but also to reshape the market environment and customer expectations. Our strategy is built on the context of our changing operating environment, capitalising on its opportunities and mitigating risks.

Quick links

Megatrends

There are several megatrends affecting, if not disrupting the property, facility, cleaning and infrastructure maintenance during the coming years. We at Alltime believe these drivers will reshape, the industry landscape and what it will take to be a leading company in it.

Energy transition

We believe switching from fossil fuels to electric and other cleaner energy sources will accelerate in the future. This megatrend is already in good progress, and developing technology as well as tightening regulation, for example EU’s CSRD directive, will likely drive even more ambitious customer and stakeholder expectations in the near future.

Climate change

We are already witnessing changes in weather patterns. For a Nordic company with outdoor maintenance in its service offering, this drives more demand for our services, but also has significant operational impacts that require adaptation. Moving from four clear seasons to a mix of different, more unpredictable weather conditions impacts what, when and how we provide services.

Digitalisation

Our industry has potential for a giant productivity leap. Facility and maintenance businesses have historically been laggards in adopting digital solutions. We believe that companies that have early-on invested in scalable and adaptable digital platforms will be able to leverage AI opportunities in creating operational excellence and new customer solutions.

Cyber security

Being a safe and secure partner will be increasingly important in a new reality of hybrid and online threats. We expect industry cyber security standards to be set notably higher, as we are dealing with customer and user data. For this reason customers are will likely opt to work with partners with reliable systems, processes and security measures.

Market environment

We have estimated the maintenance and cleaning services industry to be worth approximately 23 billion euros per year in the Nordic and Baltic countries. The industry is currently characterised by rapid market consolidation, with frequent M&A activity from large players. Key drivers for market consolidation and our reasoning behind M&A growth strategy include:

- Size matters. Economies of scale drive profitability and enable higher investment capacity. This is especially the case when all acquisitions are fully integrated and all units are using same ERP, CRM and HR systems under one unified brand. This also allows benefiting from cross-border cost synergies.

- Investments are needed particularly for creating competitive advantage through digitalisation, technology and competence building of personnel.

- When all operations are under one strong brand, it more effectively drives a powerful employer brand. This creates a better position to compete for top talent in a tightening job market.

- A wider, cross-border service network and nationwide operations are attractive for cross-border customers, who are looking for efficiency, transparency and same quality standards everywhere.

- Larger companies have better readiness to address increasing ESG reporting requirements and customers’ expectations.